loyalty apps

Seeing fewer customers, fast-food companies turn to loyalty apps

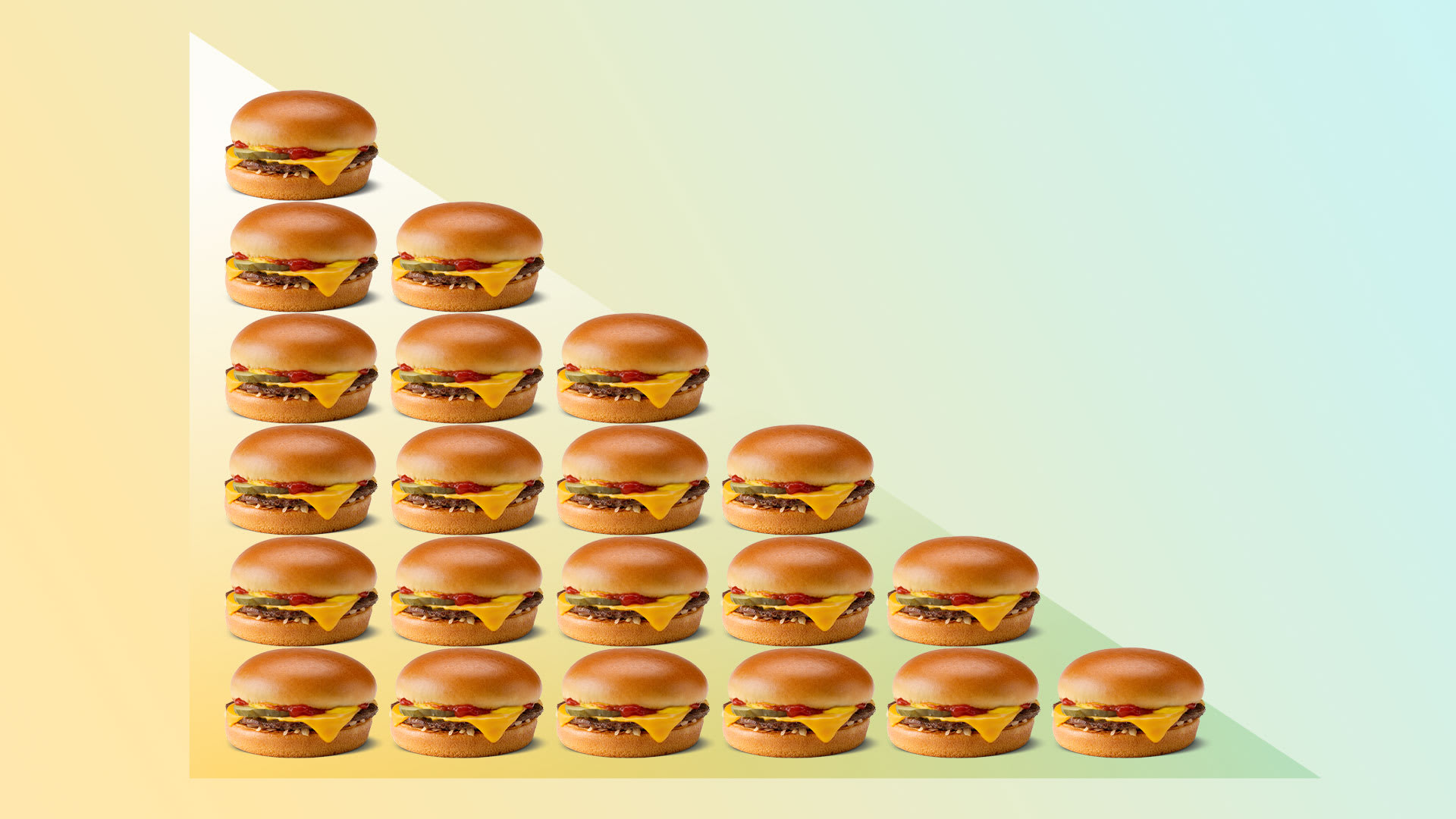

The rising price of food is contributing to budget-conscious diners cutting back.

The rising price of food is leading budget-conscious diners to cut back on their fast-food consumption, prompting companies to seek new strategies to retain their customer base. In both the U.S. and Japan, fast-food chains are increasingly turning to loyalty apps and point cards to attract and maintain customers.

In the U.S., approximately 25% of low-income consumers—those earning less than $50,000 annually—have reported reducing their fast-food intake. Around half have also cut back on visits to fast-casual and full-service restaurants. This change comes amid a staggering 20% increase in food prices from January 2021 to January 2024. The Household Pulse Survey reveals that 50% of people earning less than $35,000 a year are struggling with everyday expenses, with nearly 80% feeling significant stress due to the price hikes.

For instance, Lauren Oxford, a part-time musician in Tennessee, used to enjoy McDonald’s regularly, but has scaled back her visits due to rising prices. McDonald’s has seen a 10% price increase, making Oxford question the value of her purchases. This trend reflects broader consumer behavior shifts, as reported in the Federal Reserve’s Beige Book, which highlights that many low-income consumers are seeking bargains or additional support from community organizations.

In Japan, similar adjustments are occurring. Rising food prices have also affected Japanese fast-food consumers, though the impact varies. Fast-food chains like McDonald’s Japan and Mos Burger have raised prices, leading Japanese consumers to alter their dining habits. Many are opting for smaller portions or seeking more affordable options. Recent surveys indicate that low-income households in Japan are increasingly preparing meals at home and reducing discretionary spending.

To adapt to these changes, fast-food chains in both countries are leveraging loyalty apps and point cards. In the U.S., chains like McDonald’s and Domino’s use apps to offer exclusive discounts and promotions. McDonald’s frequently provides app-based deals such as 20% off or free delivery with larger orders. Domino’s has adjusted its loyalty program by reducing the minimum purchase amount to earn points and decreasing the number of purchases required for a free pizza, making it more accessible for lower-income consumers.

In Japan, loyalty programs are also evolving to address consumer concerns about affordability. Many Japanese fast-food chains offer point cards and app-based rewards to incentivize repeat business. For example, McDonald’s Japan uses a point card system where customers earn points for each purchase, which can be redeemed for discounts or free items. Mos Burger has a similar point system, allowing customers to accumulate points with each purchase and redeem them for discounts or special offers. These loyalty programs not only help attract cost-conscious diners but also encourage frequent visits.

Other Japanese chains, like Lawson and 7-Eleven, have expanded their loyalty programs to include digital options. These convenience store chains offer point cards that accumulate points for each purchase, which can be used for discounts on future transactions. Additionally, some chains are integrating these point systems into their mobile apps, providing a seamless way for customers to track their rewards and access special promotions.

Overall, as both U.S. and Japanese fast-food chains navigate the challenges of rising food prices, they are increasingly relying on loyalty apps and point cards to retain and attract customers. These programs offer a way to provide value and incentives to budget-conscious consumers, helping to maintain customer engagement amid changing economic conditions.

Comments

Post a Comment